Table of Content

If you need to obtain these documents, you can contact the Adjutant General’s Office of the National Guard of your state. For Reserves and National Guard members, there is not a discharge document like those for other armed services members. You must submit evidence of your honorable service and the annual retirement points summary as part of the application process.

There is a longer list of benefits that includes things like the fact that you can use VA Loans over and over again throughout your lifetime. It is also extended to the surviving spouses of service members who have passed. If your first questions about VA loans are “What are the VA loan requirements” and “Am I eligible? We will also give a quick VA loans 101 to explain what they really are and how to get a VA loan. As with many federal government benefits, determining eligibility is half the battle. Better yet, Homes for Heroes can help you find out how to qualify for a VA loan.

Servicemembers, Veterans, and National Guard and Reserve Members

You must have served in an active-duty capacity during peacetime for at least 181 days. Service requirements depend on when, how long you served, and your character of service. When you contact a specialist or lender, they can calculate your debt and credit, and run your credit score from the three major credit agencies. Want to take cash out of your home equity to pay off debt, pay for school, or take care of other needs?

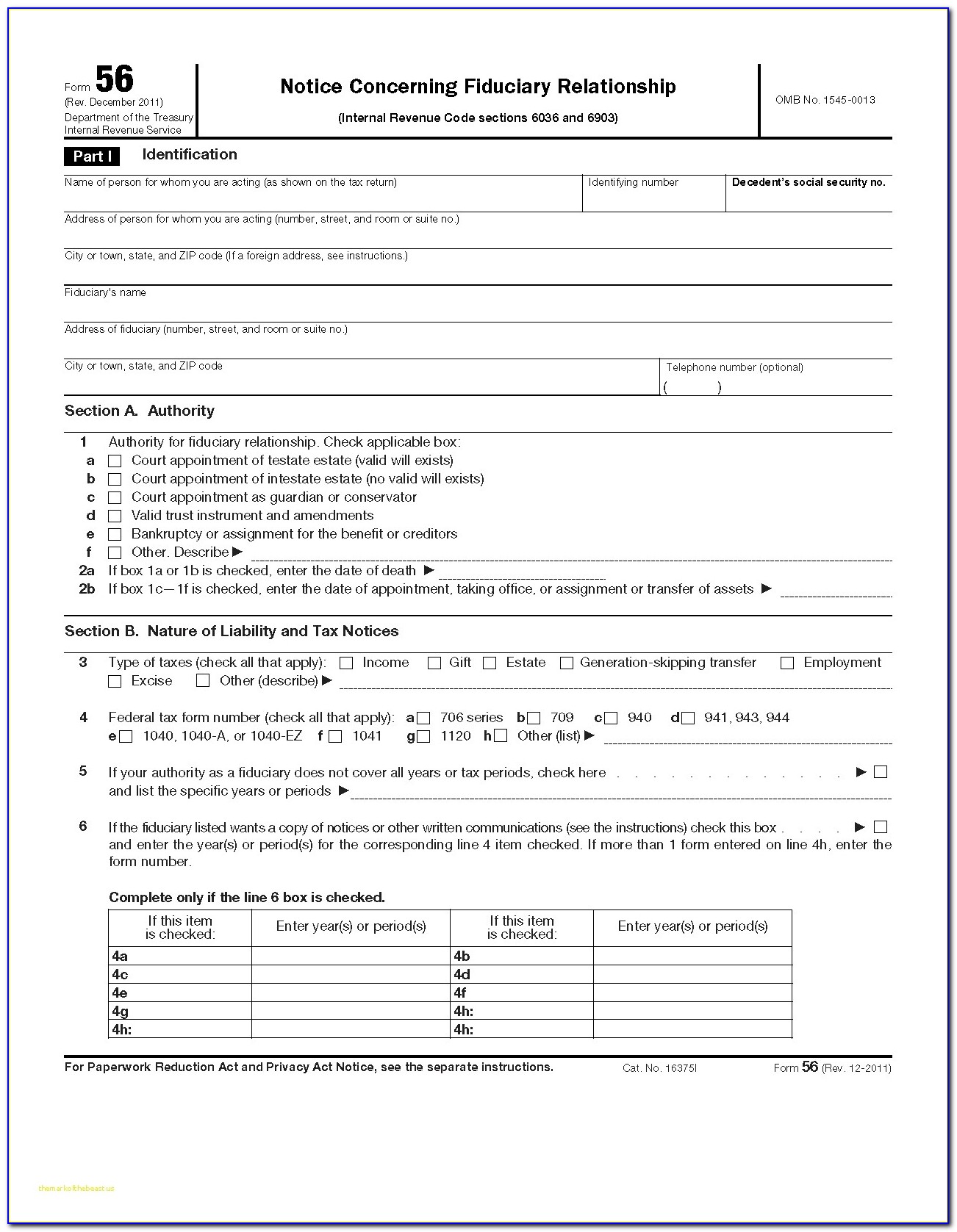

The DD-214, together with the Form DD-214, must be filled out by individuals who have served in the military and are entitled to receive a discharge or release from active duty. Surviving spouses will also need a COE to verify eligibility and utilize their VA loan benefits. Getting a COE as a surviving spouse depends on whether or not you're receiving Dependency and Indemnity Compensation.

Main pillars of the VA home loan benefit

The Veteran Health Care and Benefits Improvement Act of 2020 increased eligibility for VA Home Loans for current and former National Guardsmen. The individual is the spouse of a service member who died in the line of duty or due to a service-related disability. If your previous home was purchased using a VA Loan, and that loan was paid off by the new owners, the full entitlement may have been restored. More recently, the Veterans Housing Benefits Improvement Act of 1978 expanded and increased the benefits for millions of American veterans.

When it comes to VA loans, veterans of the United States Armed Forces United States have various options to choose from. For instance, there are a variety of loan and refinancing options available, better interest rates, and more affordable downpayments. In addition to credit score, the VA requires qualified Veterans to maintain a certain amount of income left over each month after paying all major expenses. The excess, known as residual income, should be enough to cover typical family needs, such as food, transportation and medical care.

How Spouses Can Verify Their VA Loan Eligibility

The current law does not allow an individual who is a member of either the National Guard or Reserves but is not called to active duty to be considered a veteran. A veteran who receives a discharge that falls short of honorable can apply for an upgrade to their release and be subject to examination according to the Veterans Administration’s Character of Discharge Criteria. If the veteran successfully gets a discharge change, they will apply for a COE and a VA loan.

If you wish to request a replacement, you can send a secure email and a replacement will be sent to you. If you do not qualify under any of the specific sections mentioned above for acquiring a VA home loan, you cannot get a Certificate of Eligibility. There are a lot of questions about the Certificate of Eligibility for VA loans. By visiting the eBenefits website, you will be able to obtain your Certificate of Eligibility . If you already have login credentials, simply click the Login link. However, if you do not have login credentials, you will have to register to use this service.

The VA loan process typically takes 30 to 45 days once you're under contract on a home, although every buyer's situation is different. Applying for a VA loan doesn't obligate you in any way to a particular lender or to move forward with the homebuying process. By enforcing residual income requirements, the VA increases the chances of borrowers earning sufficient income to meet all financial obligations and ensures borrowers have a cushion in the event of an emergency. Surviving spouses can reach out to a Veterans United loan specialist with questions or for more details.

Hero Rewards offers are limited and/or restricted in Alaska, Kansas, Louisiana, and Mississippi. You must be enrolled with Homes for Heroes and be represented at closing by a Homes for Heroes Real Estate Specialist to be eligible for home price savings. You must work with a Homes for Heroes Mortgage Specialist and business affiliates to be eligible to receive additional service-related savings.

At Home for Heroes we understand the importance of developing a great working relationship with your mortgage loan officer, and real estate agent if you’re looking to purchase a home. In obtaining a VA loan, it’s important to remember that the Veterans Administration only guarantees and insures the loan. All three of these organizations have VA loan requirements for lending funds. If you are a discharged National Guard or Reserve member, there are a few different documents you will need. Individual states regulate the National Guard, which means you should contact the Adjutant General’s Office in your state to request NGB Forms 22 and 23. Reserve members need to obtain their Retirement Points Statement along with proof of honorable service.

Find out how to change your address and other contact information in your VA.gov profile for disability compensation, claims and appeals, VA health care, and other benefits. You must have satisfactory credit, sufficient income, and a valid Certificate of Eligibility to be eligible for a VA-guaranteed home loan. The eligibility requirements to obtain a COE are listed below for Servicemembers and Veterans, spouses, and other eligible beneficiaries. The certificates of eligibility for VA benefits do not expire. However, once you have been discharged from active duty, you will need a new COE if you obtained it while serving on active duty . If you are a discharged former Guard member who did not serve on active duty, you will need your NGB-22, your National Guard records of service for each of your serving periods, and your NGB-23U .

The process of receiving the certificate is fairly straightforward, but it shouldn’t be overlooked. However, the process may vary depending on the person’s military status, country, and specific situation. Get a Quote A VA approved lender; Not endorsed or sponsored by the Dept. of Veterans Affairs or any government agency.

No comments:

Post a Comment